One could be forgiven for being optimistic these days. The stock markets are up 30% from their lows of March 2009, even taking into account the recent correction; housing starts and new home purchases showed surprising strength in Canada in June; job losses in the US and Canada seem to be slowing; lower mortgage rates and gas prices have freed up cash in consumer’s pockets and allowed more people to keep their homes; auto sales seem to be bottoming out.

Then again, there are the negatives; personal and corporate bankruptcies continue to rise; the threat of a trade war looms large over world markets; distrust in the US Dollar may leave all of us without a stable international reserve currency; massive annual deficits and the resulting mushrooming national debts of the G20 create the impossibility of repayment and igniting inflation in the long run.

Which set of headlines do you wish to believe? The reality is that both are correct – the short term good news does not detract from the long term structural problems that will result from the immediate policies adopted to fight the economic crisis. There are segments of the manufacturing and service economies that will never be the same as we slowly emerge from the 21st century’s Great Recession. Governments have a responsibility to be honest with those who will suffer under the “new normal” of its aftermath as well as be brave enough to adopt policies to encourage economic growth that do not rely on spending money that they do not have.

The North American economy fell off a cliff in the fourth quarter of 2008 as consumer finance dried up, corporate debt markets ceased efficient trading and the stock markets began to tank. The decline was so steep and sudden that as statistics begin to appear for the fourth quarter of 2009, they will use month over month comparisons against the depressed figures of the previous year; so even an anemic improvement will be hailed as evidence of a recovery. Take auto sales as the easiest example; auto sales were down anywhere from 30-50% (depending on the brand in question) in the final quarter of 2008. The annual US run-rate of new car sales had declined to 10 million units per year from 16 million in 2007, with the most recent annual rate coming in around 9.5 million units per year. Imagine if the US run rate improves to 10.5 million units per year in the fourth quarter of 2009? Statistically, this will show a 10% improvement, and will be trumpeted as additional evidence that the worst is behind us, that confidence is improving, or whatever other tired headline the newspapers will offer. Economists will mention, sheepishly, that this is still a long way from a healthy US auto market of 13-15 million units per year, but this more sane analysis will get buried next to the obituaries. Growth is growth, no matter how tepid! Hallelujah, the consumer is back!

The North American economy fell off a cliff in the fourth quarter of 2008 as consumer finance dried up, corporate debt markets ceased efficient trading and the stock markets began to tank. The decline was so steep and sudden that as statistics begin to appear for the fourth quarter of 2009, they will use month over month comparisons against the depressed figures of the previous year; so even an anemic improvement will be hailed as evidence of a recovery. Take auto sales as the easiest example; auto sales were down anywhere from 30-50% (depending on the brand in question) in the final quarter of 2008. The annual US run-rate of new car sales had declined to 10 million units per year from 16 million in 2007, with the most recent annual rate coming in around 9.5 million units per year. Imagine if the US run rate improves to 10.5 million units per year in the fourth quarter of 2009? Statistically, this will show a 10% improvement, and will be trumpeted as additional evidence that the worst is behind us, that confidence is improving, or whatever other tired headline the newspapers will offer. Economists will mention, sheepishly, that this is still a long way from a healthy US auto market of 13-15 million units per year, but this more sane analysis will get buried next to the obituaries. Growth is growth, no matter how tepid! Hallelujah, the consumer is back!

Celebrating a minor uptick in auto sales will be cold comfort to the hundreds of thousands of former auto industry workers who have seen their jobs disappear, never to return. What’s worse is that for many of them their employers went bankrupt, compromising the pensions that were once the top prize for years of auto industry employment. This misery extends to second and third tier auto suppliers as well; giant auto parts manufacturer Lear filed for bankruptcy last week, demonstrating how the shock wave of automotive restructuring has dug deeply into the manufacturing economy. Aside from some minor modifications to unemployment insurance admissibility in Canada, neither the US nor the Canadian governments have any strategy to assist these workers o find new employment; their industry is permanently retrenched. If a sustained auto recovery arrives five to six years down the line most will be too old to rejoin the workforce in any position comparable to the ones they previously held.

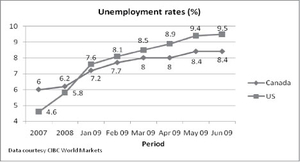

US unemployment is likely to exceed 10% before this recession concludes and may continue to rise even during the recovery period as companies pursue restructuring. The Canadian unemployment rate has not risen as far and as fast, but may ultimately remain elevated if our exporters do not recover their lost markets or discover new ones, along with the hindrance of a Canadian Dollar that is more closely related to the price of oil than our broader economic fundamentals. The unemployment rates illustrated in the table below could see the US and Canada exchange positions as the US spends trillions to create jobs at home and seeks to exclude its trading partners from the benefits of its expansionist policy.

One bright spot in the Canadian employment figures is that Canadians are turning to enrepreneurship to counter the economic downturn. The CIBC table below providing a detailed analysis of Canada’s employment statistics for June 2009 shows a significant rebound in self-employment, which is good news for the economy as a whole since small business creates 80% of all Canadian jobs and is almost entirely Canadian owned.

Our big US brother is compounding the problem.

We are used to government not having all the answers, but the least it could do is not add to the problem. However, actions taken on many fronts by the Obama administration will permanently curtail growth in the US for decades to come. The trillions of dollars of new US federal debt will require massive tax hikes on the middle class in order for them to be repaid one day. The taxpayer will have to find that money somewhere, and lower consumer spending will be the result. It is expected that consumer spending will decline from nearly 70% of the US economy in recent years to the long run average in the low 60% range from the previous 50 years. This amounts to a loss of approximately $1 trillion in consumer spending, and all he jobs that go with it.

The Obama administration does not want to admit that the consumer, also known as the taxpayer, is tapped out. Consumers have been using their credit cards as a stop-gap measure to offset declines in their earnings, running up their balances in the hope that they will be able to pay them back in the future. The credit card reform legislation imposed on the banks by the US administration sought to curtail credit card profits on consumers’ backs, but the end result will be more restrictive credit, higher interest rates for most (a great irony) and higher default rates. Improvements in consumer spending will likely be hampered by the tighter credit that will result, which is counter-intuitive to the original intent of the legislation.

The Obama administration is hindering the effectiveness of its own stimulus plan with its Buy America statute that even US manufacturers are having difficulty complying with. The result will be that higher prices will be spent for certain goods that will take longer to procure and the effect of the stimulus package will be delayed, most probably until such a point as it adds to long term inflation. Canada is the US’s closest trading partner and we would import that inflation even if we were not responsible for creating inflationary conditions in our own economy.

While the US has clear, if also contentious economic policy, Canada is plagued with successive minority governments that limit the ability of parliament to act decisively. As is evidenced by the pressures to adopt a $60 billion dollar stimulus package and the rancor over employment insurance reform, we are ending up with macroeconomic policy based on the lowest common political denominator. Canada is fortunate that it has entered this recession in the best condition of all the G8 nations but it risks losing that advantage if it does not address the increasing pressures for the reduction of greenhouse gas emissions versus our reliance on natural resources for much of our export-driven wealth creation.

Surprise crises and lower growth will leave many behind.

Dominique Strauss-Kahn, the head of the World Bank made critically important comments at the last Davos conference regarding the quality of banks’ assets worldwide. He said that financial crises do not truly end until the balance sheets have been cleansed – and the banks are far from having come clean on the true quality of the assets on their balance sheets. Estimates are that the banks have addressed about $1 trillion US of troubled assets so far, but there could be up to $3 trillion more in assets to be written off or restructured. This means that those holding the shares of these banks will be subject to additional rounds of wealth debasement as these assets are written down or off entirely. Small investors will be drawn back to the shares of financial institutions in successive waves, only to find out that another series of troubled assets will imply further losses. It is telling that in the recent run-up of shares from the March 2009 loans the banks issued hundreds of billions of dollars worth of new shares to improve their tier one capital, fully expecting that they will need that cushion in the future.

For middle-class North Americans who own equities as well as a home, they have seen calamitous declines in the value of their assets anywhere from 20 to 50 percent. If the predicted high-tax, slow growth, overly-regulated economic environment comes to fruition it will take decades for these families to rebuild their lost wealth. For many baby boomers, the rebuilding will take too long and they will never fully recover, forcing them to rely on the support of the state just as governments will be seeking to reduce costs like pensions and health care. Many of the newly unemployed are being forced into entrepreneurial self-employment in an effort to rebuild their assets. One can only hope that many of them succeed, since North America will need all the entrepreneurs it can get to create more successful people to tax incessantly.

Welcome to Quebec, we’re already used to it.

If anyone knows a thing or two about high tax and slow growth, it’s Quebeckers. We have lived with this destructive social compact of wasteful state interventionism funded by excessive taxation, overly-generous social benefits and coddling of labour and other special interest groups for over three decades, making us experts on what the US may look like at the end of the Obama administration. Much has been written recently in The Metropolitain about how Montreal has come to represent the worst of these traits; over-governed and regulated, excessively taxed and subjected to the petty manipulation of its citizens by over-zealous bureaucrats. A full generation of Montrealers has grown up under this malaise and has accepted it as a fait accompli. One hopes that the Americans and less docile non-Quebeckers will resist this trend and their eventual rejection of its implications will spill over into our borders and effect real change in Quebec. Francois Legault put it best when he said that Quebec is suffering a quiet decline, unable to recognize its weaknesses and seek change. Americans may wake up a decade from now and find that they too have been stifled into the same slow decline, and hopefully they will muster their historical fight to overturn it.