Canadians can rarely feel smug when comparing themselves to their US neighbors, but when it comes to our banking sector our airs of superiority are justified. While the Obama administration contemplates an overhaul of financial industry regulation and punitive taxation of banking executives’ bonuses, Prime Minister Harper announced in Davos that Canada has no intention of “micro-managing” Canada’s banks. Canada’s financial system is recognized as being among the healthiest in the world and certainly the finest among the G8 – our banks were well capitalized and their conservative lending models averted the massive asset write-downs that plagued other developed-world banking systems.

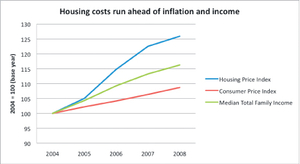

What Canada and the US have in common is historically low interest rates, basically zero from the US Federal Reserve and a point and change from the Bank of Canada. Consumers in both countries have been using the low mortgage rates that have resulted to finance new real estate purchases or refinance existing mortgages at cheaper rates. The difference between Canada and the US is that US real estate prices have dropped 30% from their pre-recession peak, while in markets like Florida the correction extends to 50% in certain sub-markets. In Canada, no such correction has taken place; the Canadian real estate market has recovered from its late 2008 to early 2009 weakness and prices are moving ahead at a rate that far exceeds the inflation and family income growth rates. Recent studies show that Vancouver has become “severely unaffordable” for middle-class families and the insinuation is that the divergence between the growth in real estate prices and the family income needed to support it is unsustainable. Yet, Canadian consumers continue to pour into the new construction and resale markets with a zeal not seen elsewhere in the developed world with the exception of Australia, whose integration with the Chinese market allowed it to be barely brushed by the worldwide recession.

Table based on data from Statistics Canada Eventually this real estate party is going to come to an end; interest rates will rise and those investors who bought just a little too much house in an overheated market will find that their payments will rise as they re-negotiate their one and two-year term mortgages. While the majority of investors have taken fixed-rate five year terms, that still leaves a lot of other buyers who took shorter terms or variable rate mortgage products. All it takes is 10% of sellers in a market to be forced into accepting slashed prices to move their properties to cause a widespread price decline for all sellers, since the expectation in the market will switch towards falling, rather than rising resale values.

Eventually this real estate party is going to come to an end; interest rates will rise and those investors who bought just a little too much house in an overheated market will find that their payments will rise as they re-negotiate their one and two-year term mortgages. While the majority of investors have taken fixed-rate five year terms, that still leaves a lot of other buyers who took shorter terms or variable rate mortgage products. All it takes is 10% of sellers in a market to be forced into accepting slashed prices to move their properties to cause a widespread price decline for all sellers, since the expectation in the market will switch towards falling, rather than rising resale values.

There are several other potential triggers for a crisis in consumer debt beyond the question of problems with mortgage refinancing; rising gas prices is the next possible culprit, and government taxation is another. Canadians are fortunate that gas prices have stabilized around the dollar a liter mark over the past year, far from the $1.50 we saw at the peak in late 2008. However, as worldwide demand for oil increases to fill in the 5 million barrel per day gap between production and consumption that we are now enjoying, you can bet that oil will once again rise above $120 USD per barrel and that the price at the pump will rise in sympathy. For the average consumer who drives two to three hundred kilometers per week, the extra $20 per tank could be just enough to ruin the monthly budget and cause a retraction in household discretionary spending, which economists have been counting on to push forward the recovery. Oil also manifests itself in home heating, plastics, food (remember delivery costs?) and much of what we touch. If oil prices rise, then so does the cost of our groceries, clothing, toys, pretty much all goods and services we consume and the money to pay for these costs all comes out of a household budget that is already strained. In late 2008, many American consumers where choosing between putting gas in the car and paying the mortgage. Many figured that they could get another house more easily than they could find another job to commute to, and the cascade towards repossessions began. The situation would not be so dire in Canada, but it would certainly occur in our more expensive urban markets like Vancouver and Toronto.

Taxation is the silent income killer that is right around the corner, though governments will not discuss it in direct terms. Ontario has announced a $25 billion provincial deficit for the coming fiscal year – does anyone believe that they can close this gap over time with spending cuts alone? Ontario will move to tax its citizens in any way possible, squeezing the family budget even tighter and further slowing the recovery. Quebec’s $4.5 billion deficit looks paltry in comparison, but Quebeckers will face a sales tax increase and new user fees to help bring our finances back into line. The federal government insists that the budget can be balanced by 2015 without tax increases, but Canada’s own budget watchdog, Mr. Page, insists that there is a $15-20 billion gap that will remain to be filled, depending on the macroeconomic assumptions employed. In short, governments are just waiting for household finances to improve to the point at which it is OK to increase their tax burden, so governments can improve their own balance sheets.

Whether the debt in Canada is held by consumers or our governments, we will all suffer the constraints of rising interest rates, oil, goods and service prices and taxes. The squeeze on our pocketbooks will slow economic growth, curtail new wealth creation and prolong high unemployment. For home buyers, there is one sage piece of advice; buy less home than you can afford today, or wait a few years and pick it up for less from the buyer who ignored that advice.

Comments

Please login to post comments.