Investors around the world could be forgiven for expressing some optimism given the stock market results for the week ending on March 13th 2009: US markets posted the biggest gains in twenty years, with the Dow up over 9%, with similar gains on the broader S&P 500 index and the Canadian TSX. One of the catalysts for this surge of optimism was an announcement by Citigroup that after receiving $45 billion in government assistance, the bank was able to post an $8 billion dollar profit in their current fiscal quarter. As a result, the stock was up nearly 80% on the week, to just under two dollars. With so much cash on the sidelines for so long, investors rushed into the banking sector, sending the S&P Financials index up 34% (!) for the week.

Investors should not be so giddy with their money. The US government, under Treasury Secretary Tim Geithner, has announced that investigators will comb the assets of all US banks with more than $100 billion in assets (about 2/3 of all US banks) to determine their ability to survive two scenarios of protracted recession, as well as evaluate the quality of the assets on their books. These assets include trading assets like financial instruments purchased as investments by the banks as well as conventional assets like mortgages, commercial and personal loans provided to individuals and businesses. The timing for this “stress test” as it has been called, could not be worse – the banks were just beginning to recover depositor and investor confidence after months of disastrous headlines filled with billions in write-offs, billions more in capital injections, and the stigma of thousands of layoffs in the financial industry. Just as a relative calm had settled in, the US government is going to discover that a whole tier of regional and local institutions have questionable assets on their books and they will require saving – either through outright closure, forced merger, or a new round of government capital injections. Transparency in the financial industry is a lovely platitude, but this was not the time to pry open the books and expose the ugliness that lies between the covers.

Investors should not be so giddy with their money. The US government, under Treasury Secretary Tim Geithner, has announced that investigators will comb the assets of all US banks with more than $100 billion in assets (about 2/3 of all US banks) to determine their ability to survive two scenarios of protracted recession, as well as evaluate the quality of the assets on their books. These assets include trading assets like financial instruments purchased as investments by the banks as well as conventional assets like mortgages, commercial and personal loans provided to individuals and businesses. The timing for this “stress test” as it has been called, could not be worse – the banks were just beginning to recover depositor and investor confidence after months of disastrous headlines filled with billions in write-offs, billions more in capital injections, and the stigma of thousands of layoffs in the financial industry. Just as a relative calm had settled in, the US government is going to discover that a whole tier of regional and local institutions have questionable assets on their books and they will require saving – either through outright closure, forced merger, or a new round of government capital injections. Transparency in the financial industry is a lovely platitude, but this was not the time to pry open the books and expose the ugliness that lies between the covers.

The misery of the “mark to market” requirement

Since the subprime mortgage mess created a new class of junk investments in securitized mortgage products, these assets have plummeted in value because no one has wanted to buy them. The US Treasury has moved in and purchased some of these troubled assets from financial institutions, but the government cannot sweep in and pick up all of the toxic assets that the banks would like to unload. Now, some of these assets are still performing, meaning that “only” 20% of their loans may be in arrears. Normally this would mean that the market value of the security should fall be a corresponding amount, depending on the yield versus risk-free investments available in the marketplace. The problem is that since no other financial institution wants these assets, the price may be discounted by 50% or in some cases, much more. As a result, banks and other institutions have been forced to write down these assets using the depressed values in the marketplace, even if the cash flow being generated by those assets would justify a higher price if there was a healthy trading market for them.

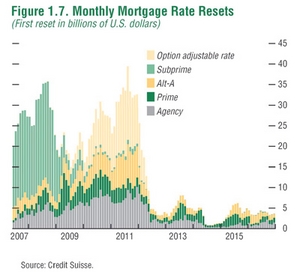

The fear is that the “stress test” will uncover a whole new series of non-traditional mortgage products like “jumbo loans” (loans greater than $625,000), “Alt-A” loans, which were given to less than prime borrowers but who still had better credit scores than “sub-prime”, and then the now well-known sub-prime loans which include low/no documentation loans (liar loans) and low credit score clients. According to a study of the mortgage market by Credit Suisse from January 2009, we are only 1/3 of the way through the mortgage crisis. There are two more waves of troubled mortgages that are supposed o see their interest rates re-set to much higher levels, precipitating a new wave of home repossessions and continued pricing declines in the US housing stock. The banks will want to dump the securitized assets represented by these mortgages, and there will be no buyers. Therefore, the Fed stress test will force a new wave of asset write-downs that could decimate the banks’ capital and put many banks into negative territory.

Without the stress test, these banks would have been able to wait for the Obama Administration’s plan to deal with these toxic assets, which has been the subject of a great deal of speculation. The US government has been slow to deal with the disposition of these toxic assets because the Department of the Treasury is still vastly understaffed – there are over a dozen under-secretarial positions that remain unfilled, and this has slowed the formulation of policy at this critical juncture.

Who’s going be the bad bank?

There has been a lot of discussion amongst economists over the pros and cons of creating a “bad bank” like the fabled Depression-era Resolution Trust Corporation which was created to wind-down the banking crisis of that era. They call it a “bad bank” because it becomes a home for all the bad assets like the securitized mortgages that financial institutions no longer want. Essentially, the federal government would capitalize the bad bank, and it would exchange good securities, like cash, for the toxic assets. Once the banking industry has washed itself of these troubled investments, they would be able to lend with confidence once again, or so the theory goes. The bad bank could be patient enough to hold these assets to maturity, or work them out to realize maximum value and even turn a profit for the government.

The Swedes created a bad bank after their financial crisis in the 1990s – however, this was a tiny country whose problems were measured in the billions of dollars, while the US is a world power whose problems are measured in the trillions. The US government is hesitant to get into the difficult task of valuing these hundreds of billions of dollars (or trillions, who really knows) of distressed assets – if they pay too much for them, the US taxpayer will be on the hook for the losses.

The US government’s response is anticipated any day now. There probably won’t be a US bad bank – instead, the government is likely to provide financing to hedge funds and other vulture-like buyers of distressed assets if they agree to buy these holdings from the banks. The government believes that these specialized investors and traders are better positioned to determine a fair price for these assets and will intervene more quickly than government would once the financing was put in place. You should expect all kind of interesting new investment funds to pop up offering the possibility to participate in the enormous potential profits to be had as these assets are worked-out and liquidated over time.

Do mortgage-holders get a break as well?

The housing market must be stabilized – and the government knows that a whole slew of new foreclosures are imminent as the loans made in 2006 and 2007 come up to have their interest rates re-set. There will be some kind of relief for homeowners facing this imminent pain – the banks who will be allowed to get these toxic assets off their books will also have to assist homeowners to re-work their mortgages to keep them in their houses and avoid adding to the glut of foreclosed housing stock that is decimating pricing for existing and new home construction.

Ironically, now that the Federal Reserve has set the overnight rate practically to zero, buyers can get mortgages below 5%, if they qualify. The government will put a program in place to incentivize the banks to get as many existing mortgages up for renewal into new mortgages that take advantage of these historically low rates and allow them to stabilize their family finances. If a homeowner can convert a variable rate mortgage into a 25 year fixed-rate mortgage at 5%, then that family will probably have more cash available on a monthly basis for renewed consumer spending. Since consumer spending is 2/3 of the US economy, the real long-term objective of any homeowner stabilization plan is to revive the consumer economy and re-ignite spending on durable consumer goods like automobiles.

Canada’s banks will feel the stress, too

Canada’s banks are rated as the most solid in the world – but they suffered under forced write-offs last Fall under the mark-to-market rule, since they were holding some of the same toxic assets as the US banks. If the US stress test forces American banks to revalue a new series of toxic assets, then any of these securities held in Canada will be subject to the same revaluations with balance sheet losses as the result. Canadian banks do not have representatives around the boardroom tables at the Federal Reserve, nor at the Treasury Department, and their lobbyists at Congress will be powerless to influence the valuation of the assets in question.

Canadian bank shares have continued to fall through 2009, with a respite this past week. The smarter players in the market have probably figured out that though Canadian banks may be the strongest the world has to offer, they may be somewhat weaker once the US stress test evaluation is complete at the end of April. If you believe in this analysis and are interested in buying Canadian bank shares, then maybe you should wait until the merry month of May.

Commentaires

Veuillez vous connecter pour poster des commentaires.