The objective of this article is not to add to the hysteria surrounding the Fiscal Cliff budget negotiations in the US – the mainstream media has already done an excellent job in that respect. I would rather present a contrarian view of the implications of the Fiscal Cliff (FC) and entice you, dear reader, to love the FC the way we learned to love the bomb during the Cold War.

The concept of MAD (Mutually Assured Destruction) was a key element of deterrence that kept the peace during the Cold War, while the nuclear powers fought proxy wars around the globe but avoided direct confrontation. The FC was born in a similar fashion in that it represented such a vicious cocktail of spending cuts and tax increases as to be unimaginable in actual application. Conceived in the summer of 2011 as part of the agreement to raise the US debt ceiling, it was supposed to force the Republican and Democratic leadership back to the negotiating table before January 1, 2013 to strike a grand bargain on fiscal reform. What Americans are experiencing now is the economic equivalent of the Cuban Missile Crisis, as the US political establishment careens towards the fiscal precipice with increasingly shrill rhetoric that makes a deal difficult to conceive before the deadline.

All is not lost; unlike a nuclear exchange, it is possible to go over the cliff and climb back up again. There is a lot to be gained by allowing the Bush-era tax cuts to expire, end the payroll tax holiday introduced in 2009 and impose over $100 billion in cuts on federal spending, heavily weighted towards the Defence Department. In my view, there are only winners by embracing this strategy rather than by making a deal before the January 1st deadline.

First, the Republican leadership finally unshackles itself from the Grover Norquist no-tax increase pledge that was initially introduced in the early 1990s and was signed, to date, by a majority of Republicans in the House of Representatives. Speaker John Boehner knows that any deal with Democrats has to involve some sort of tax increase. Closing loopholes is just not enough; there will have to be increases in upper-income tax rates if any substantial deficit reduction is going to result. If the stalemate to January 1st is maintained, then the Bush tax cuts for upper earners expire and Boehner can blame it on the Democrats instead of having voted for a package that raised rates, in defiance of the Norquist pledge. The Republican leadership can then negotiate with greater latitude to reduce some rates for the upper middle class and small business owners while allowing the rates to stay high for the truly wealthy. The reform of the Republican economic orthodoxy can only begin when Grover Norquist is deflated and run out of Washington.

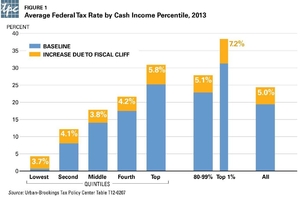

For the Democrats, the elimination of the Bush tax cuts is the culmination of the Obama victory in the presidential election. Obama repeated incessantly that it was “time for well-off folks to pay a little more” and as of January 1st, 2013 that is exactly what will happen, to the tune of $300 to $350 billion dollars. A victory of this magnitude will allow the Democratic leadership to negotiate in-turn a long-term restructuring of Medicare and Medicaid benefits that are a real threat to future spending levels. Democrats will give back on rates later on in 2013 as part of a more comprehensive reduction in tax loopholes to remove distortions and favoritism in the tax code.

The American people also have the opportunity to win in the long run if Congress engages in meaningful tax code reform. The last major overhaul of the tax code occurred under Ronald Reagan in 1986. It resulted in a reduction in loopholes and favoritism, a flattening of tax rates and paperwork simplification. Its implementation cemented the economic recovery begun in 1982 which created $19 billion in new wealth during the Reagan presidency. The average American family will face thousands of dollars of tax increases throughout 2013 unless something is done; there is nothing better to focus the efforts of an American taxpayer than a lighter wallet on payday, and the pressure on Congress and the White House will be enormous and unrelenting. The resulting political catharsis is precisely what is required to break the cycle of cynicism and bellicose diatribe that has characterized US political discourse for the last decade (at least). A new era of wealth creation can result if politicians can overcome their animosity and make a solid bipartisan effort to create a new tax code for the next quarter century.

If America’s political leadership does nothing and takes $600 billion dollars out of the US economy in one year, it will likely result in a mild recession and a one percentage point increase in the unemployment rate. The $600 billion corresponds to 4% of GDP, which is a considerable amount but still not as onerous as what the European Union imposed on Greece. If the draconian cuts were deemed appropriate for a far weaker economy like Greece’s, then why can’t it be supported by the most entrepreneurial free-market economy in the world? Cutting the deficit in half in one year may actually get corporations to start investing the 2 trillion dollars of cash that is sitting idle on US balance or out of the country, shielded from US fiscal uncertainty. It may just be possible that doing nothing and letting the US economy absorb the shock may be the best long term strategy of all. Warren Buffet calls the Fiscal Cliff a fiscal slope, and appears far less worried than most in interviews. Maybe the Oracle of Omaha has a better understanding of long-term economics than the political pundits feeding the hysteria on a daily basis. On January 1st, 2013 no US politician will be able to hide from the effects of their decision to act or not to act in the interest of those who elected them and the whole world will be subjected to the fallout. Put your crash helmets on, it’s a long way down.

Commentaires

Veuillez vous connecter pour poster des commentaires.