Par Robert Presser le 28 mai 2009

Relaxing the mark-to-market rules means we will never know what the banks are really worth

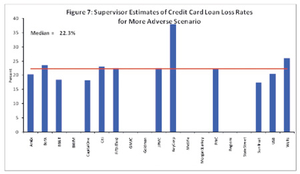

The Federal Reserve’s stress test results are in and to no one’s surprise, all the big US Bank Holding Corporations (BHCs) passed. Getting a passing grade in the stress test, more formally known as the Supervisory Capital Assessment Program (SCAP) was a lot like getting a passing grade in gym class – just because everyone gets by, this does not mean that all the subjects are equally capable and robust. The SCAP report indicates that 10 of the 19 largest US banks should collectively raise an additional $75 billion USD in tier-one capital in order to bolster their reserves to face a protracted recession. The report outlines the various types of assets held by the banks, including toxic assets like securitized mortgages, commercial loans and mortgages originated in-house, consumer loans and revolving credit card debt.

The Federal Reserve’s stress test results are in and to no one’s surprise, all the big US Bank Holding Corporations (BHCs) passed. Getting a passing grade in the stress test, more formally known as the Supervisory Capital Assessment Program (SCAP) was a lot like getting a passing grade in gym class – just because everyone gets by, this does not mean that all the subjects are equally capable and robust. The SCAP report indicates that 10 of the 19 largest US banks should collectively raise an additional $75 billion USD in tier-one capital in order to bolster their reserves to face a protracted recession. The report outlines the various types of assets held by the banks, including toxic assets like securitized mortgages, commercial loans and mortgages originated in-house, consumer loans and revolving credit card debt.