The Federal Reserve’s stress test results are in and to no one’s surprise, all the big US Bank Holding Corporations (BHCs) passed. Getting a passing grade in the stress test, more formally known as the Supervisory Capital Assessment Program (SCAP) was a lot like getting a passing grade in gym class – just because everyone gets by, this does not mean that all the subjects are equally capable and robust. The SCAP report indicates that 10 of the 19 largest US banks should collectively raise an additional $75 billion USD in tier-one capital in order to bolster their reserves to face a protracted recession. The report outlines the various types of assets held by the banks, including toxic assets like securitized mortgages, commercial loans and mortgages originated in-house, consumer loans and revolving credit card debt.

The $75 billion is a very low figure compared to the trillions of dollars of potential losses associated with the Troubled Assets Relief Program (TARP) previously implemented by the Treasury Department. The ratio of required capital to be raised versus the massive basket of troubled assets implies that the valuations associated with these assets are healthier than first expected. Indeed, the SCAP report highlights that the improvements in the financial markets since April have seen share and asset prices rise across the board and this has greatly improved the solidity of the bank’s balance sheets.

But who prices the illiquid, troubled assets sitting on the bank’s books? These valuations used to be governed by the mark-to-market rule, which means that these assets had to be reduced in price to reflect a true market price, i.e. what a third-party financial institution or other investor would be willing to pay for them. There are two reasons why an asset may see its price reduced – it could be priced for a “quick sale” because the vendor requires short-term liquidity, or because the asset is non-performing, either totally or partially, and should be marked-down to reflect a write-off of the portion of the asset that is no longer viable.

The current financial crisis was doubly painful for the banks because both of the above conditions were true – assets were non-performing AND institutions wanted to dump them quickly to raise cash. The accounting requirement to mark down these assets immediately is what created billions of dollars of losses on the banks’ balance sheets and deepened the crisis since no one had cash around to buy them up until the US federal government stepped in with the TARP program and the Treasury started intervening in the marketplace.

The banks were pleading with regulators for some “wiggle room” in valuing the assets for which there was no viable market. At the end of March, the U.S. Financial Accounting Standards Board (FASB) allowed the banks to hold off writing down assets that they do not intend to hold to maturity, which are known as “trading assets” or assets available for sale. Previously, a bank could only avoid writing down the value of a troubled asset if it pledged to hold that asset to maturity, like a 25-year mortgage extended to an individual who was having trouble paying at the moment, considered a temporary impairment, but the ability to pay was expected to recover over time.

This apparent relief measure for the banks also helped them pass the SCAP test – all of a sudden, assets on the books that were problematic, for which there were no buyers, could be subjectively valued in the banks’ favor. Without this relief measure, the banks would probably have been told to raise far more than $75 billion US – but we really don’t know how much more. And therein lies the problem – the banks have now been allowed to subjectively value assets on their books for which there is no market, and they have every incentive to value them as highly as possible, cross their fingers and hope for the best. The result is that as investors, no one really knows what these banks are worth anymore!

Zap, you’re frozen! No one sells, and no one gets hurt!

This new policy of allowing the banks to subjectively value the troubled assets on their books goes directly against the Troubled Asset Relief Program (TARP) that US Treasury Secretary Tim Geithner announced in March. Under his plan, the US Treasury was going to provide funding and guarantees for private sector investment funds to purchase these assets from the banks and work them out slowly, to maximize their value. This was based on the assumption that these funds would be able to get a substantial discount from the banks selling the assets to make this worthwhile, in order to earn a healthy return on investment. Now because the mark-to-market rule has been relaxed, the banks have little incentive to sell a troubled asset at a price below what they are valuing it at, and the investment funds will not pay too high a price. The result is that rather than re-creating a market for troubled assets as TARP had envisaged, the loosening of mark-to-market impedes the creation of a new market, hurts liquidity and ultimately prolongs the financial crisis.

The SCAP test covered the 19 largest banking groups in the US, but in the background, smaller US banks continue to fail. The FDIC (Federal Deposit Insurance Corporation) has taken over 33 banks since the beginning of 2009, running at a rate approximately 50% ahead of 2008, which was almost double the 2007 results. As FDIC auditors pour over the books of these failed banks, they will be assigning values to the assets on their books. Imagine that the FDIC decides to value a certain mortgage-backed security at 60 cents on the dollar at a failed small regional bank, while the same asset on the books at the Bank of America is showing at 90 cents on the dollar? This type of valuation discrepancy is what will ultimately cause the relaxation of the mark-to-market rules to collapse. Bank analysts will have to pour over the financial disclosure filings of all the major banks and review the values assigned to their assets on a case-by-case basis and compare those values to any transactions for similar assets that have occurred in the marketplace. Banks’ chief financial officers will be grilled by investors over discrepancies between self-determined and market-priced asset valuations and a new round of confidence-killing revaluations will ensue. In the long run, the fudging of mark-to-market rules undermines the transparency of the financial reporting system, weakens investor confidence in the value of bank shares, and re-enforces the illiquidity in financial markets that the TARP program was supposed to address. The score; Washington lobbyists: billions, small investors: less than zero.

Consumer debt is the next implosion for the banks

The SCAP broke down expected losses for the banks by asset class, and the most troubling result was the expected losses on outstanding credit card debt. As American consumers deal with massive layoffs, salary and benefit rollbacks and credit line reduction at their local branches, they are turning to their credit cards to make up the difference. Revolving debt has always been a credit and a curse for the US economy, sustaining consumer spending while at the same time indebting families at high interest rates that they can hardly afford. In a protracted recession, those troubled consumers still in their homes will attempt to negotiate write-offs on their consumer debt before they stop paying the mortgage that assures their shelter. Even while the US economy is showing signs of bottoming out, unemployment continues to rise as large employers like GM and Chrysler slash plant employment and close thousands of dealerships that are critical economic motors in small communities across the country. The irony is that while statistically the economy will look better on paper in the second half of 2009, it will be accompanied by sustained consumer pain and manufacturing capacity contraction.

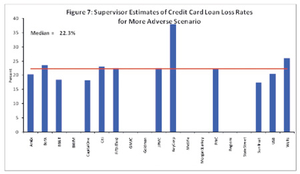

Figure 7 from the SCAP report shows that the average potential loss on credit card loans is 22.3%, a very scary figure considering that some of the institutions on the list have no credit card business whatsoever. Couple these losses with two more upcoming waves of variable mortgage rate resets and a commercial real-estate market that is only now starting to keel over and one can conclude that pain for the banks is far from over and the recent run-up in financial shares on all markets has gotten way ahead of itself.

Figure 7 from the SCAP report shows that the average potential loss on credit card loans is 22.3%, a very scary figure considering that some of the institutions on the list have no credit card business whatsoever. Couple these losses with two more upcoming waves of variable mortgage rate resets and a commercial real-estate market that is only now starting to keel over and one can conclude that pain for the banks is far from over and the recent run-up in financial shares on all markets has gotten way ahead of itself.

Canadian banks will be swept along with the US financial tide

The Canadian banks also asked for a relaxation of the mark-to-market rule and were not given the same degree of latitude by Canadian Accounting Standards Board. Therefore, we can expect that Canadian valuations of assets held by them and US institutions to diverge, with Canadian banks demonstrating more conservative, realistic values. However, in the absence of a healthy market for these securities, Canadian banks can be hit by a surprise if asset sales following an FDIC liquidation of a failed US bank do not match with the valuations on the books. The Canadian banks may be more prudent, but they are just as vulnerable to asset pricing surprises as the big US banks.

As the markets rallied over the past two months, US and Canadian banks have been issuing new equity while their bank share prices have recovered. This rush to market should be interpreted by investors as an opportune move on the banks’ part that might not be such a good deal for investors in the medium term. If any retail investors have seen their portfolios recover over the past two months, they should put on their contrarian hats and ask themselves if they should be selling some of their bank shares to the herd investors while the banks’ treasuries are busy doing the same thing. Caveat emptor!

Commentaires

Veuillez vous connecter pour poster des commentaires.